With positive news coming out of Japan and Korea,emerging markets are stepping into the positives with strategic support from governments.

International developers presence in Japan,

Equinor,Orsted,TotalEnergies,bp,CIP,RWE, SSE Renewables,OW Ocean Winds,Corio Generation

JAPAN - RAMPING UP

1.1GW awarded for Round 3

International developers presence in Korea,

Equinor,Orsted,TotalEnergies,bp,CIP,RWE, SSE Renewables,OW Ocean Winds,Skyborn Renewables,Corio Generation

SOUTH KOREA - SOME NEW MILESTONES REACHED

South Korea is entering into the OFW universe with only one industry-scale offshore wind project with international developer, technology and market practice closed in 2023

awarded at the 2024 tender including 750MW of floating offshore wind capacity

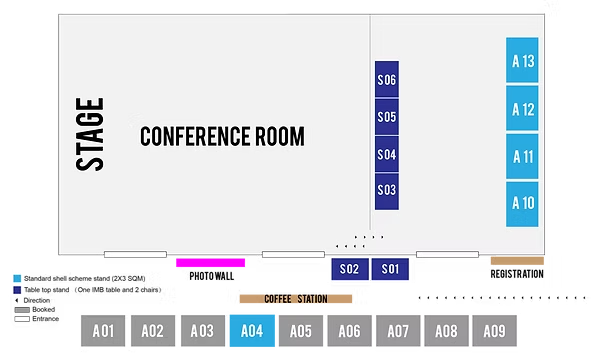

Stellar line up of industry thought leaders, policy makers, OEMs, investors, project developers, EPCs and technology gurus across the wind and energy storage value chain.

Business Development Manager

Kinewell

CEO

WindTree

Chief Design Engineer

GEDI,ENERGY CHINA

General Manager – Japan, Korea and Taiwan

Mott MacDonald

Assistant Senior Engineer

Saman Corporation

Principal

The Lantau Group

Strategic Development Advisor – APAC

Vaisala

Vice President, Global Offshore Renewables

ABS

Senior Manager – Structured Finance Senior Manager

OW Ocean Winds

General Manager

Fugro UST21

Trade and Investment Specialist for Renewable Energy

Scottish Development International,British Embassy Seoul

Country Manager South Korea

Rystad Energy

Senior Analyst, Asia Pacific Power and Renewables Research

Wood MacKenzie

Director

Herrenknecht AG

Senior Vice President

HD Hyundai Heavy Industries

Professor

Tianjin University and APEC Sustainable Energy Center (APSEC)

MD Korea

Skyborn Renewables

Advisory Consultant, Super Energy

Director

Arup

Chief Executive Officer

JB Energy – Japan Blue Energy

Founding Partner

The Lantau Group (TLG)

APAC Director

OWC

Manager of Global Offshore Renewables

ABS

Chairman

Synera Renewable Energy

Wind Business Director

LEICE Transient Technology

Principal Consultant

OWC

As the leading Offshore Wind and Hydrogen event platform in APAC, you can meet key existing/prospect project developers, partners, investors and vendors in the region. With a full range of topics to be covered at this fully packed 2 days event, you will be able to gain the most updated info of Korea and Japan Offshore Wind, Hydrogen market while exploring exciting business opportunities.

Hear from industry leaders and policy makers on the latest development of Korea and Japan's offshore wind and hydrogen industry and opportunities for investment.

Meet old friends, develop new clients and generate new leads at KJOWHS 2025